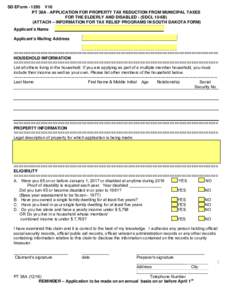

81 | Add to Reading ListSource URL: www.state.sd.us- Date: 2016-12-20 15:56:54

|

|---|

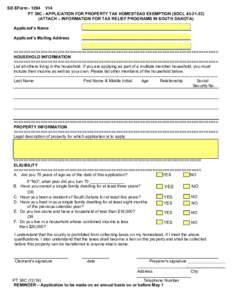

82 | Add to Reading ListSource URL: tools.cira.state.tx.us- Date: 2013-02-09 13:06:48

|

|---|

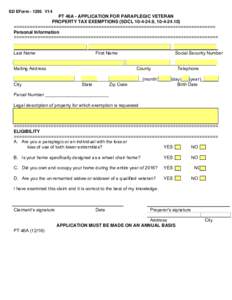

83 | Add to Reading ListSource URL: tools.cira.state.tx.us- Date: 2016-08-24 12:38:23

|

|---|

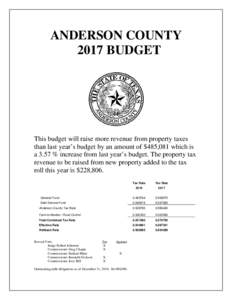

84 | Add to Reading ListSource URL: www.sohosandiego.org- Date: 2016-10-24 20:48:58

|

|---|

85 | Add to Reading ListSource URL: www.state.sd.us- Date: 2016-12-20 15:56:39

|

|---|

86 | Add to Reading ListSource URL: www.state.sd.us- Date: 2016-12-20 15:56:17

|

|---|

87 | Add to Reading ListSource URL: tools.cira.state.tx.us- Date: 2016-09-08 11:52:37

|

|---|

88 | Add to Reading ListSource URL: tools.cira.state.tx.us- Date: 2016-08-08 17:43:34

|

|---|

89 | Add to Reading ListSource URL: tools.cira.state.tx.us- Date: 2016-08-10 13:08:07

|

|---|

90 | Add to Reading ListSource URL: inde.delaware.gov- Date: 2016-12-07 10:14:17

|

|---|